inheritance tax wisconsin rates

Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Inheritance tax rates differ by the state.

. Washington DC District of Columbia. However the top graduated tax rate was reduced to 50 for 2002 with annual decreases of 1 thereafter through 2007. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions.

Wisconsin tax structure. Wisconsin is a moderately tax friendly state. Estate tax of 10 percent to 20 percent on estates above 55 million Illinois.

No estate tax or inheritance tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Tax rates can change from one year to the next.

Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. This is consistent with national averages. But you dont have to go to Florida to avoid the state estate tax.

Income tax rates in Wisconsin range from 354 to 765. As provided under EGTRAA all of the rates except those at the top remain the same as they were under prior law. However if you are inheriting property from another state that state may have an estate tax that applies.

Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000. Starting in 2023 it will be a 12 fixed rate. Surviving spouses are always exempt.

You can do it right here in Wisconsin. As of 2021 the six states that charge an inheritance tax. If the estate is large enough it might be subject to the federal estate tax.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. No estate tax or inheritance tax. The graduated tax rates ranged from 18 to 55.

The tax rate ranges from 116 to 12 for 2022. The estate tax rate is based on the value of the decedents entire taxable estate. Key findings A federal estate tax ranging from 18 to 40.

INHERITANCE AND ESTATE TAX. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Florida is a well-known state with no estate tax as well.

Thankfully there is no inheritance tax in Connecticut. These states have an inheritance tax. Estate tax of 08 percent to 16 percent on estates above 4 million Iowa.

Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1 to 2 on top of that. State inheritance tax rates range from 1 up to 16. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

The top estate tax rate is 16 percent exemption threshold. Inheritance tax of up to 15 percent. ESBT that has Wisconsin sourced income or.

Wisconsin does not have a state inheritance or estate tax. Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. The maximum credit is 1168.

Wisconsin has among the highest property tax rates in the nation. The District of Columbia moved in the. The top marginal rate was 46 for 2006 and is 45 for 2007 through 2009.

Wisconsin does not levy an inheritance tax or an estate tax. Rule Tax Bulletin and Publication P AGO A A. No estate tax or inheritance tax.

But currently Wisconsin has no inheritance tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Take a look at the table below.

Trusts and Estate Tax Rates of 2022. Rate of tax see Tax rates. People who receive less than 112 million as part of an estate can exclude all of it from their taxes.

There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms. The occasion was the 1898 report of the wisconsin state tax commission commission 3 a state agency that.

56 million West Virginia. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. GENERAL TOPICAL INDEX.

Wisconsin Inheritance Tax Return. The average effective rate is 195. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will.

ESBT income is taxed at a rate of 765 percent. The property tax rates are among some of the highest in the country at around 2. Inheritance tax wisconsin rates.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Estate tax of 112 percent to 16 percent on estates above 4 million Hawaii. Income tax rates average from 4 to 8.

Keep reading for all the most recent estate and inheritance tax rates by state. Estate tax of 108 percent to 12 percent on estates above 71 million District of Columbia. You will also likely have to file some taxes on behalf of the deceased.

Wisconsin does not levy an inheritance tax or an estate tax. In 2022 the federal estate tax generally applies to. Homeowners with total household incomes of less than 24680 who own and occupy their homes are eligible for a property tax credit.

This number doubles to 224 million for married couples.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax Comparison By State For Cross State Businesses

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Estate Tax Everything You Need To Know Smartasset

Inheritance Tax What Is An Inheritance Tax Taxedu

Wisconsin Inheritance Laws What You Should Know

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Wisconsin Estate Tax Everything You Need To Know Smartasset

100 Best Places To Retire The Sunbelt Rules Once Again In 2013 Best Places To Retire Retirement Community Best Places To Live

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Wisconsin Inheritance Laws What You Should Know

Wisconsin Estate Tax Everything You Need To Know Smartasset

Assessing The Impact Of State Estate Taxes Revised 12 19 06

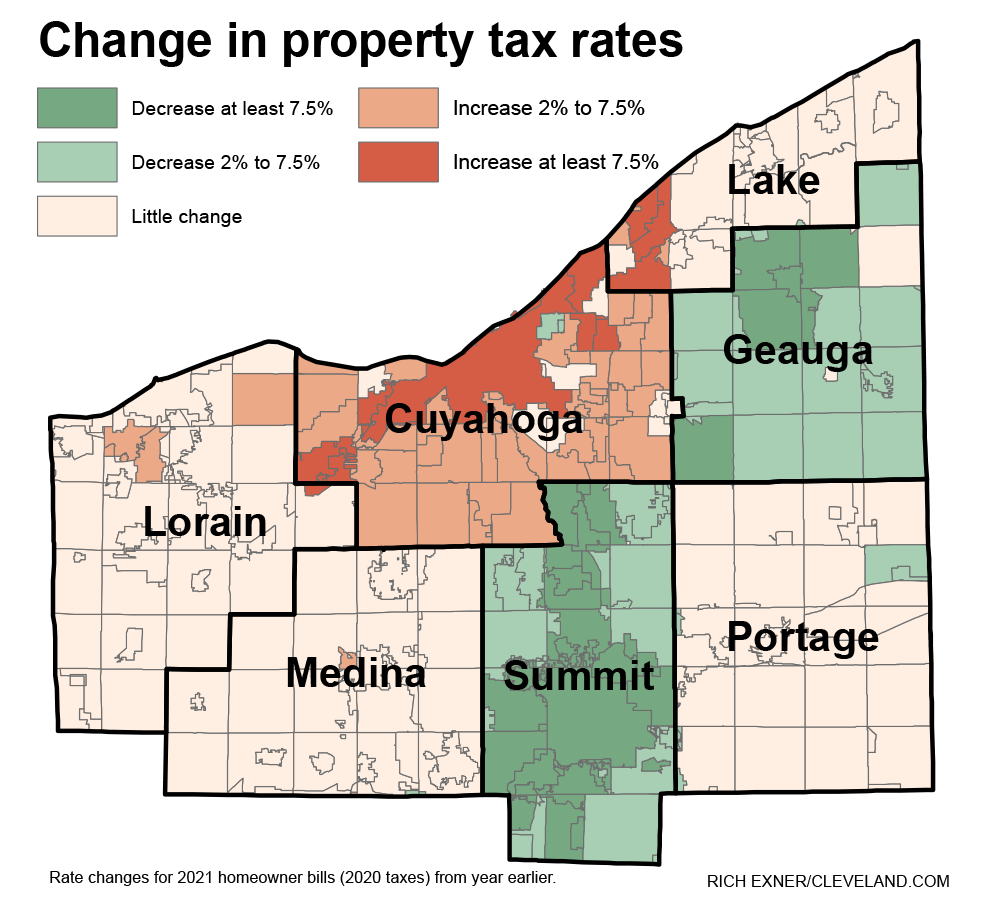

Compare Greater Cleveland Akron Property Tax Rates And Learn Why They Have Changed This Year That S Rich Cleveland Com

What Is The Estate Tax And How Does It Work Wisconsin Business Attorneys Wausau Eau Claire Green Bay

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Compare Greater Cleveland Akron Property Tax Rates And Learn Why They Have Changed This Year That S Rich Cleveland Com